Empowering Small Businesses with 401(k) Plans

Unlock up to $265,000 in SECURE Act 2.0 tax credits —redirect taxes to your team, not Washington D.C.

About PlanForge Consulting

At PlanForge Consulting, we design customized 401(k) plans for America’s small businesses (15–75 employees). Our strategies help maximize SECURE Act 2.0 tax credits, often reducing costs to nearly zero while strengthening retirement benefits for both owners and staff. We proudly support hardworking business leaders with affordable, effective retirement solutions tailored to their goals.

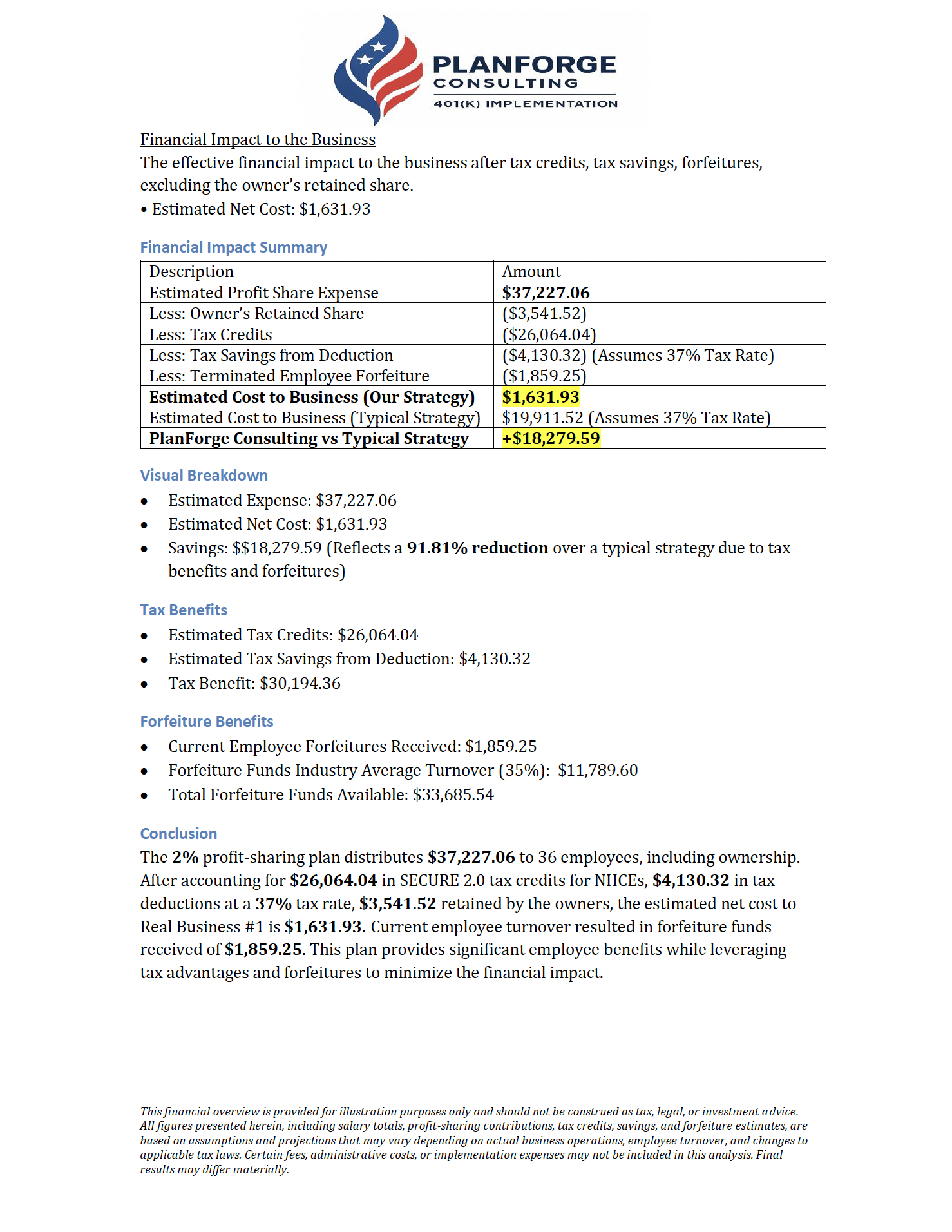

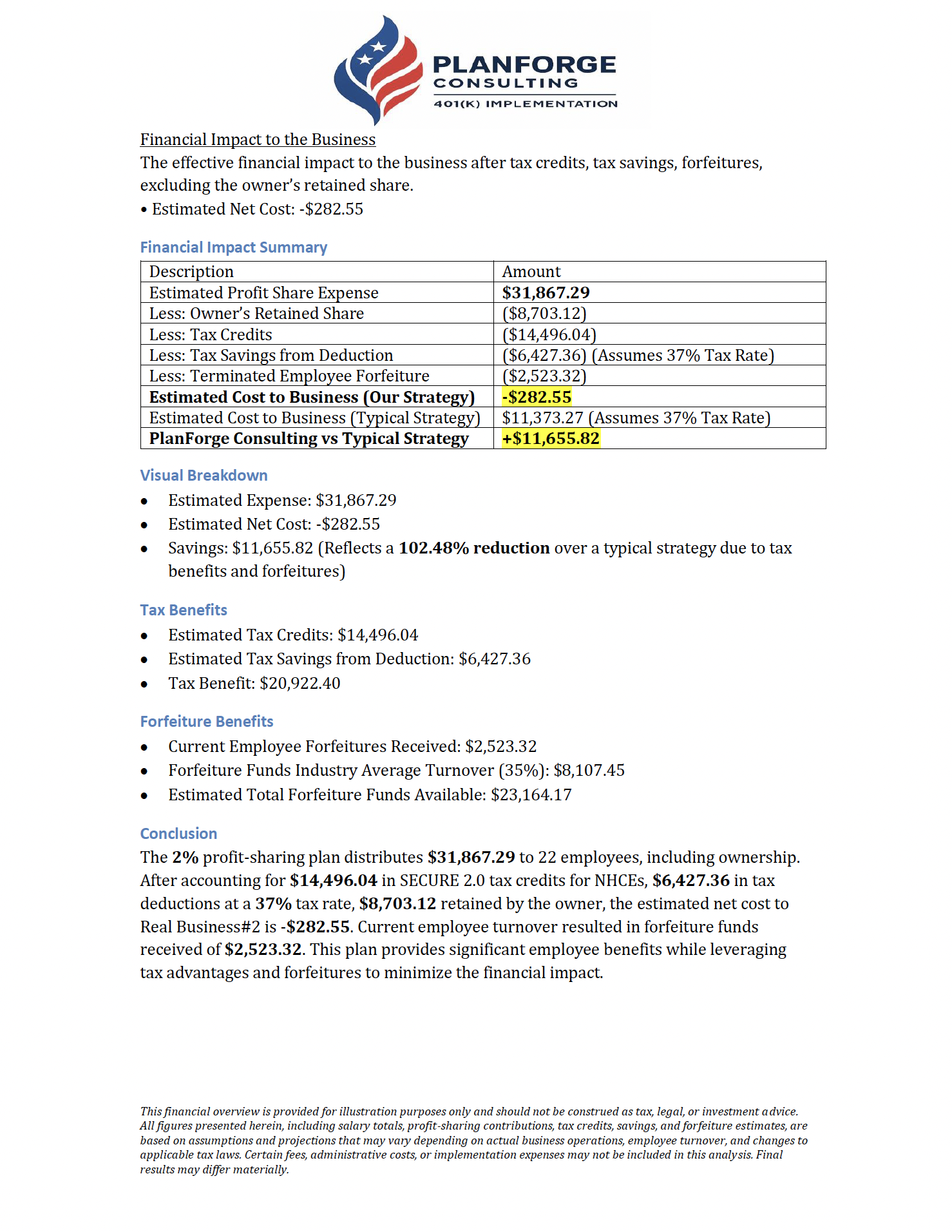

Success Stories

What happens when you pay your people, not the IRS: real outcomes from real businesses.

Join Our Referral Program Today

Earn $250–$500 for every qualified small business you refer that implements a 401(k) within 6 months of your referral — whether they choose PlanForge or another provider. We’ll confirm adoption and issue your reward.

Tax-Efficient Strategies

Use SECURE Act 2.0 credits, deductible contributions, and smart vesting/forfeitures to cut employer net cost—often to net-zero or better—while funding your team.

Boost Employee Retention

Increase participation and reduce turnover with auto-enroll, right-sized matches, and thoughtful vesting. A stronger plan builds a more engaged, loyal workforce.

Owner-Centered Design

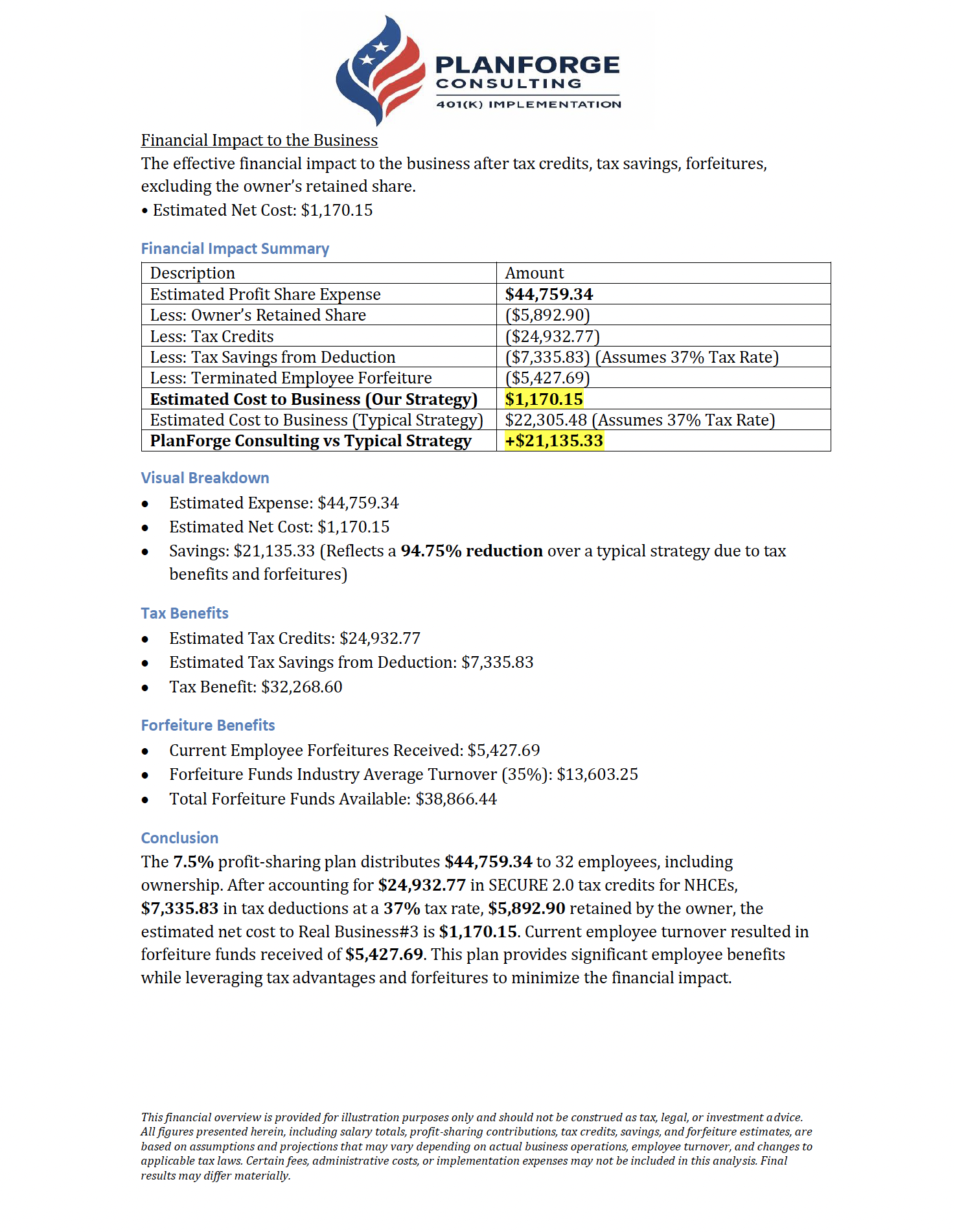

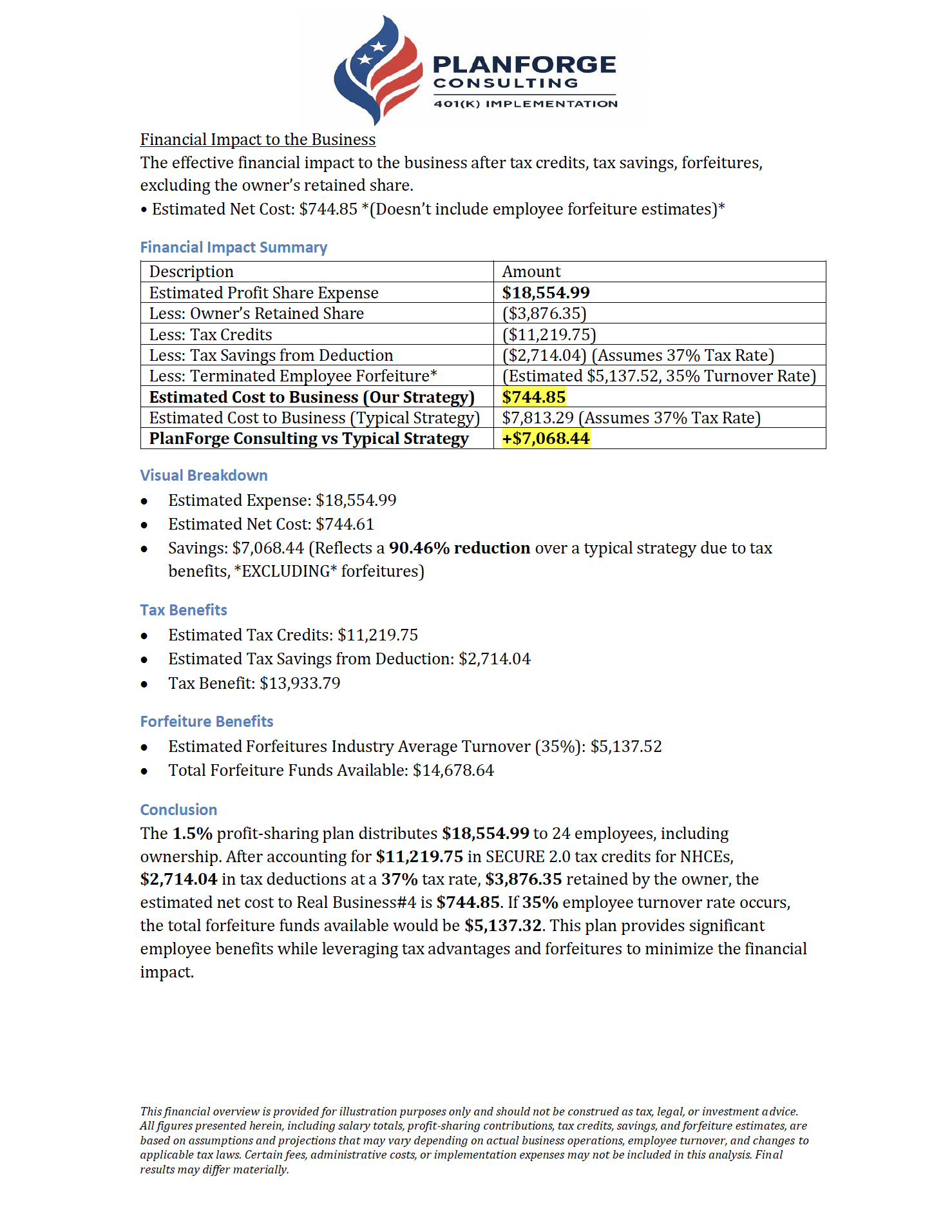

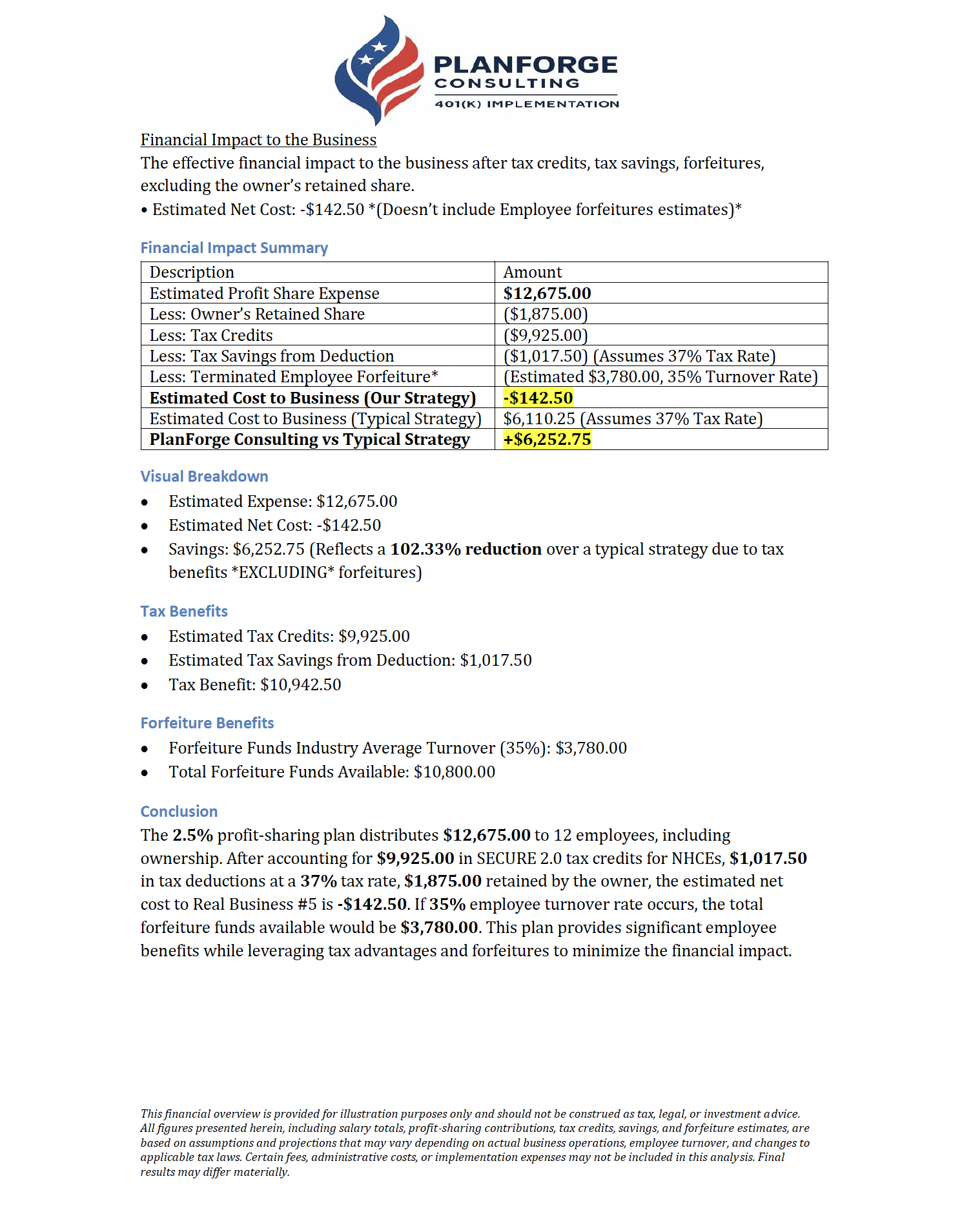

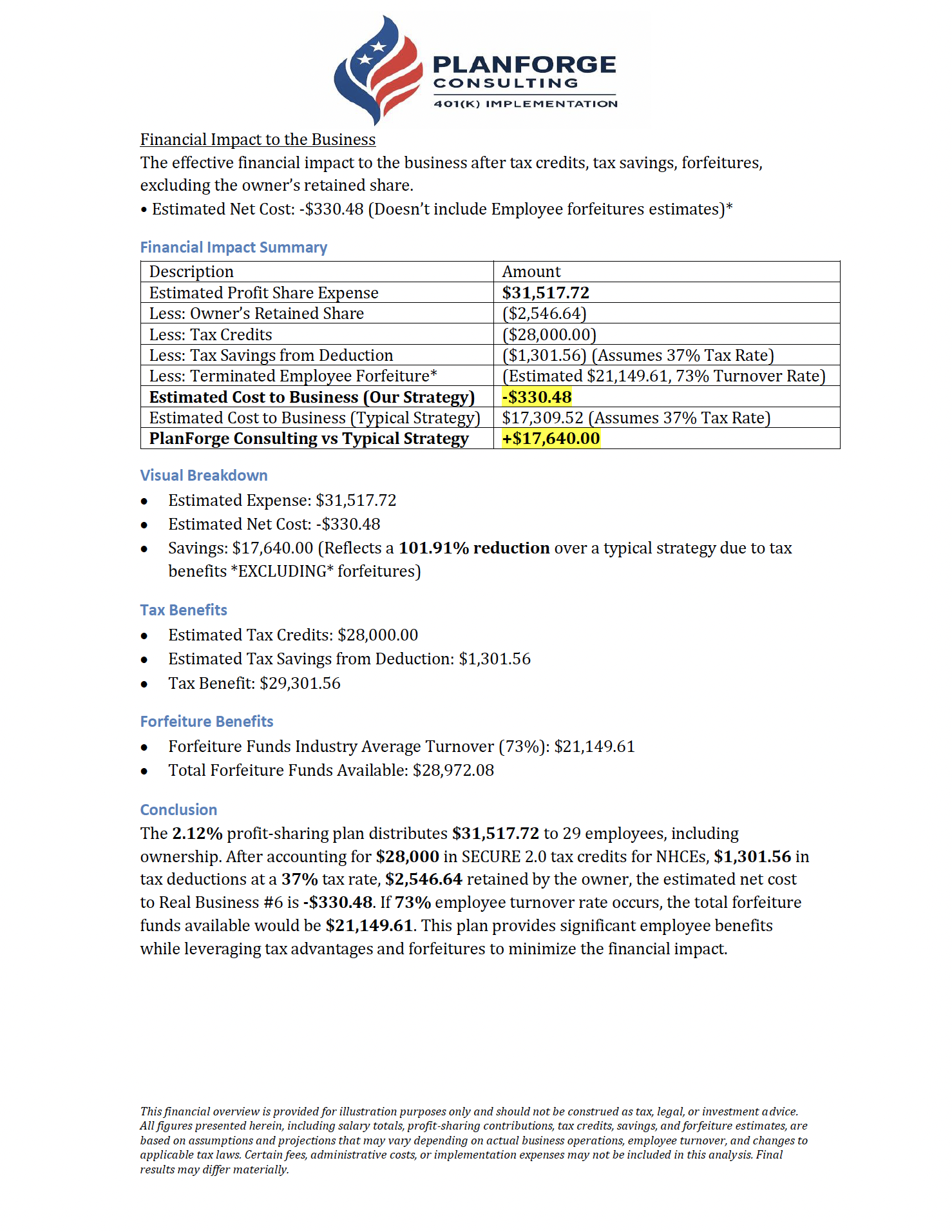

Cross-tested / new comparability designs boost owner allocations while staying compliant and controlling costs. We show a clear side-by-side: PlanForge’s net cost vs. a typical approach.

Expert Financial Guidance

Get guidance from a CFP® and a Tax & Real Estate Attorney for setup, compliance, and strategy. Use your own advisor or ours—your choice.

Information Gathering

Share last year’s W‑2s & census or complete our 3-minute Questionnaire. That’s enough to size credits, deductions, and employee demographics for your plan.

Custom Illustration

Receive a tailored PDF illustration showing PlanForge’s net cost vs. a typical approach—with credits, tax deductions, employer contributions, and estimated forfeitures.

Guided Implementation

From plan design to payroll mapping and employee meetings, we handle rollout end-to-end so your launch stays smooth and on schedule.

Compliance & Optimization

ERISA/IRS compliance, always. We maximize SECURE Act 2.0 & The Big Beautiful Bill incentives and tune matches, vesting, and forfeitures as your team changes.

See How Much Your Small Business Could Save With a Net-Zero 401(k)

Most small businesses can unlock up to $265,000 in SECURE Act 2.0 tax credits over five years when launching a new 401(k) plan — often reducing employer net cost to near zero.

Practical resources for owners and office managers—design a cost-efficient 401(k), capture tax credits, and boost retention with clear, step-by-step guidance.

Get in Touch

Contact Planforge Consulting

We’re here to help small business owners implement cost-effective 401(k) plans. Schedule a free consultation or submit last year’s W-2s for a custom quote today.

Schedule a Free Consultation

Discover how much you could save on your retirement plan. Schedule your free consultation now or call us at 214-908-2310.

Submit W-2s or Questionnaire

Upload your last year's W‑2s or fill out our Owner questionnaire to receive a personalized illustration of your potential savings.

Reach Out Directly

Have questions or interested in partnership opportunities? Contact us by email at Partnerships@PlanForge401k.com or complete our 3-minute Partnership Form. We're happy to assist you.