Discover the Benefits of Tailored 401(k) Plans

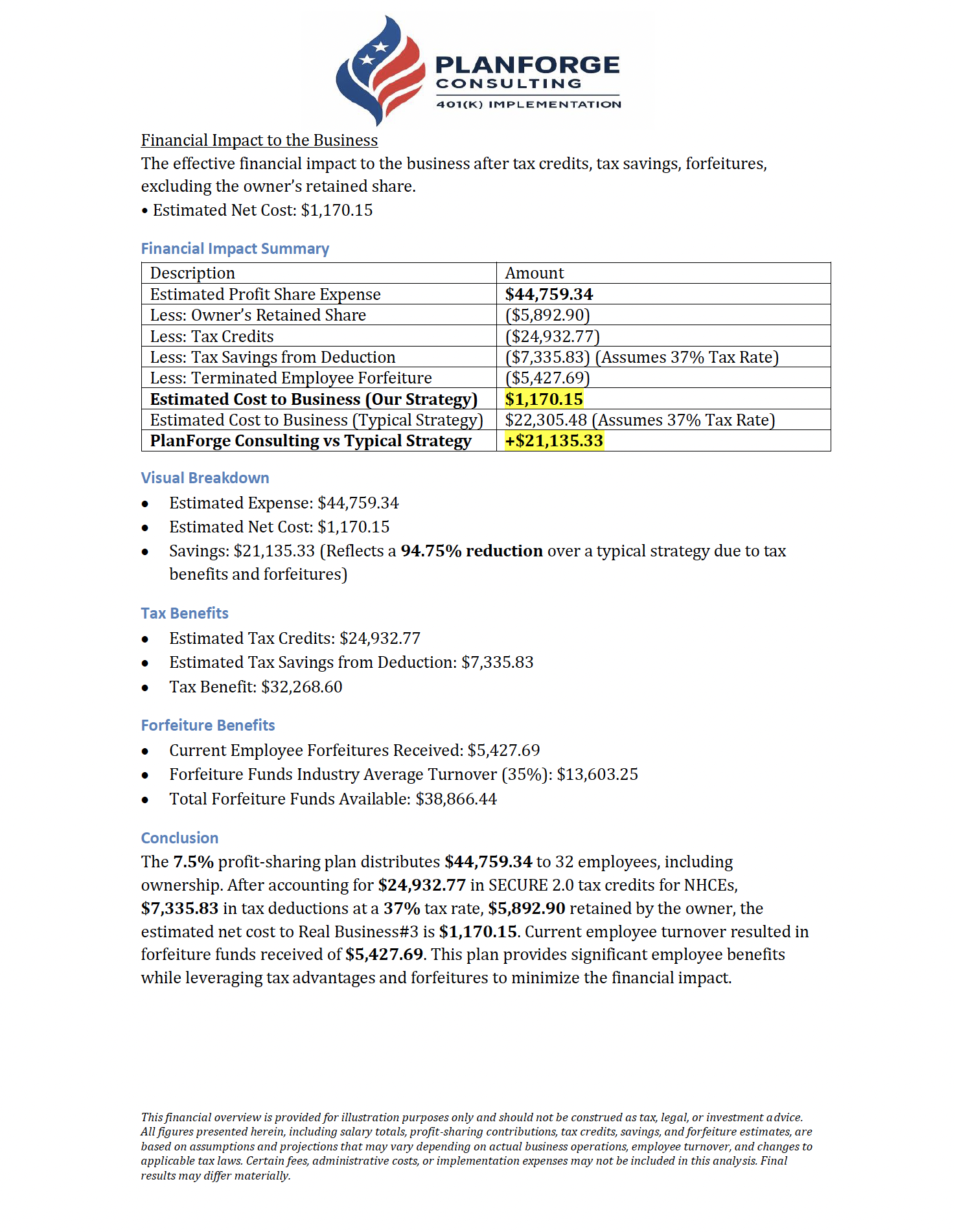

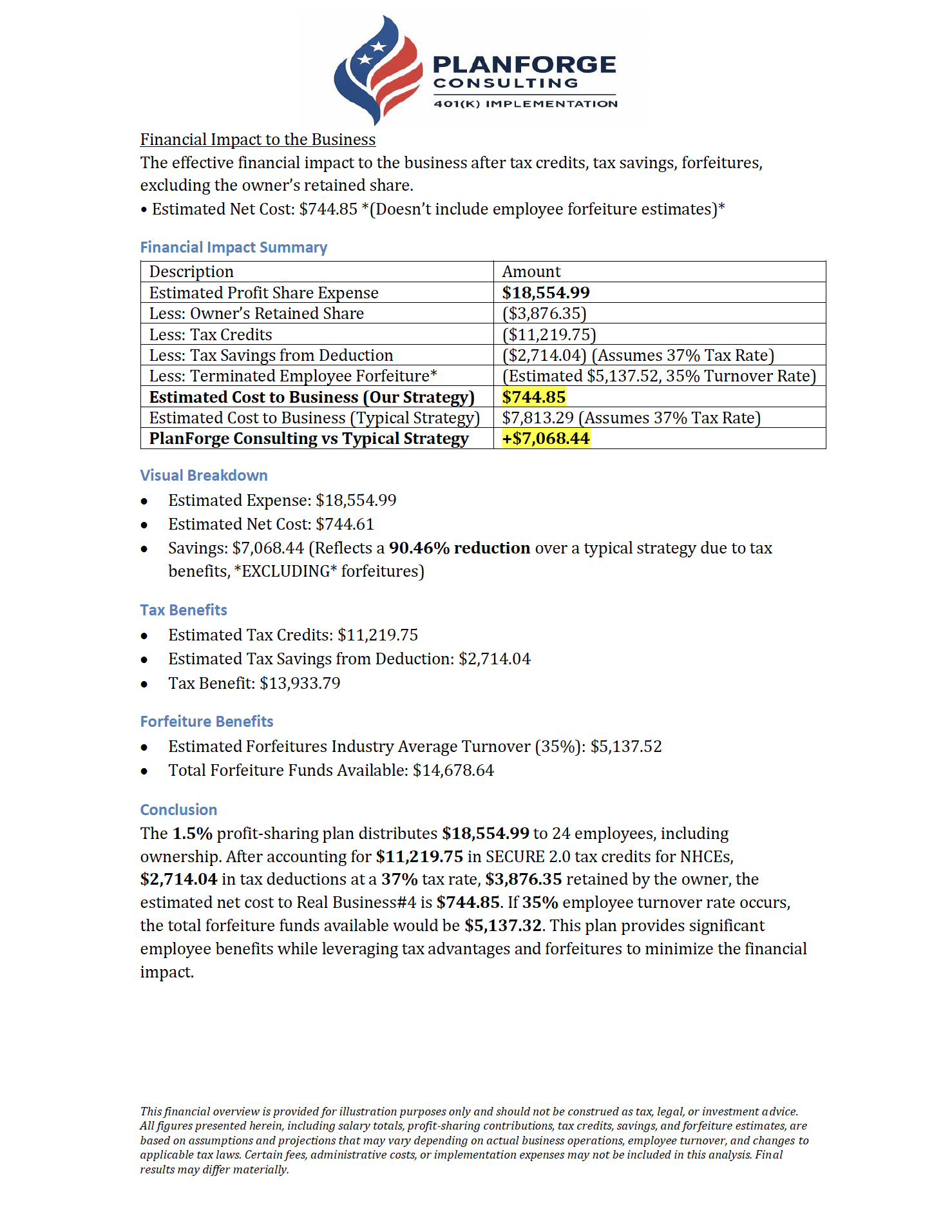

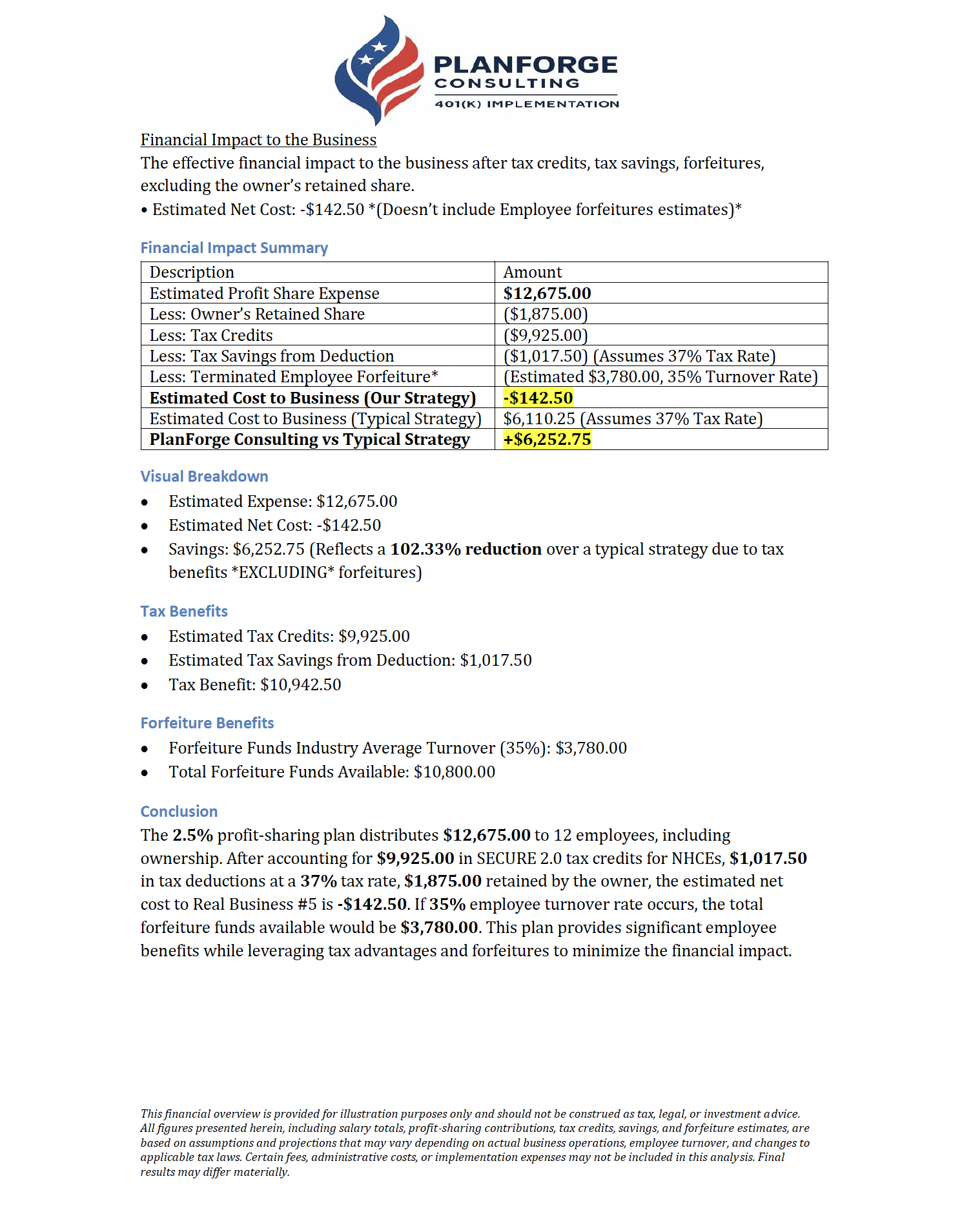

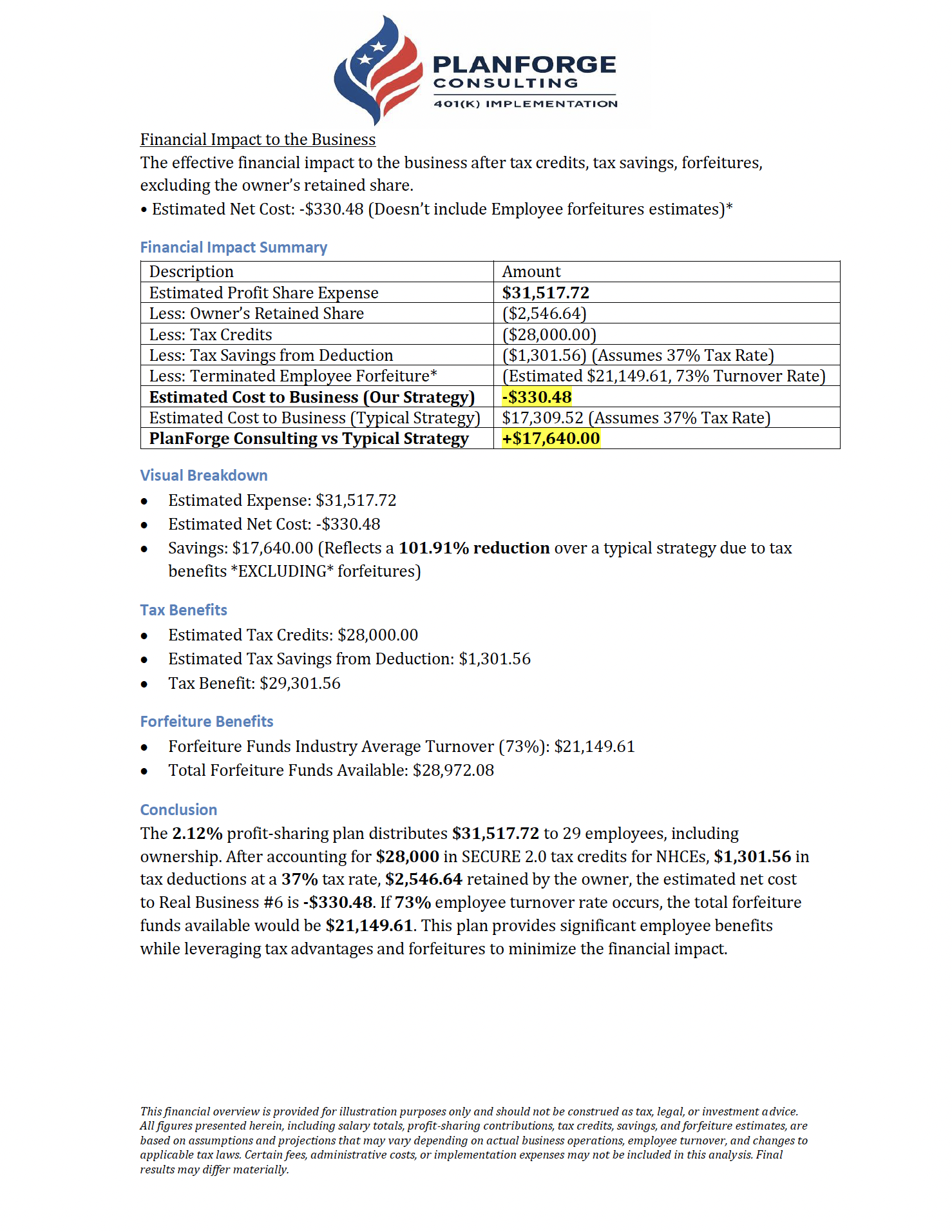

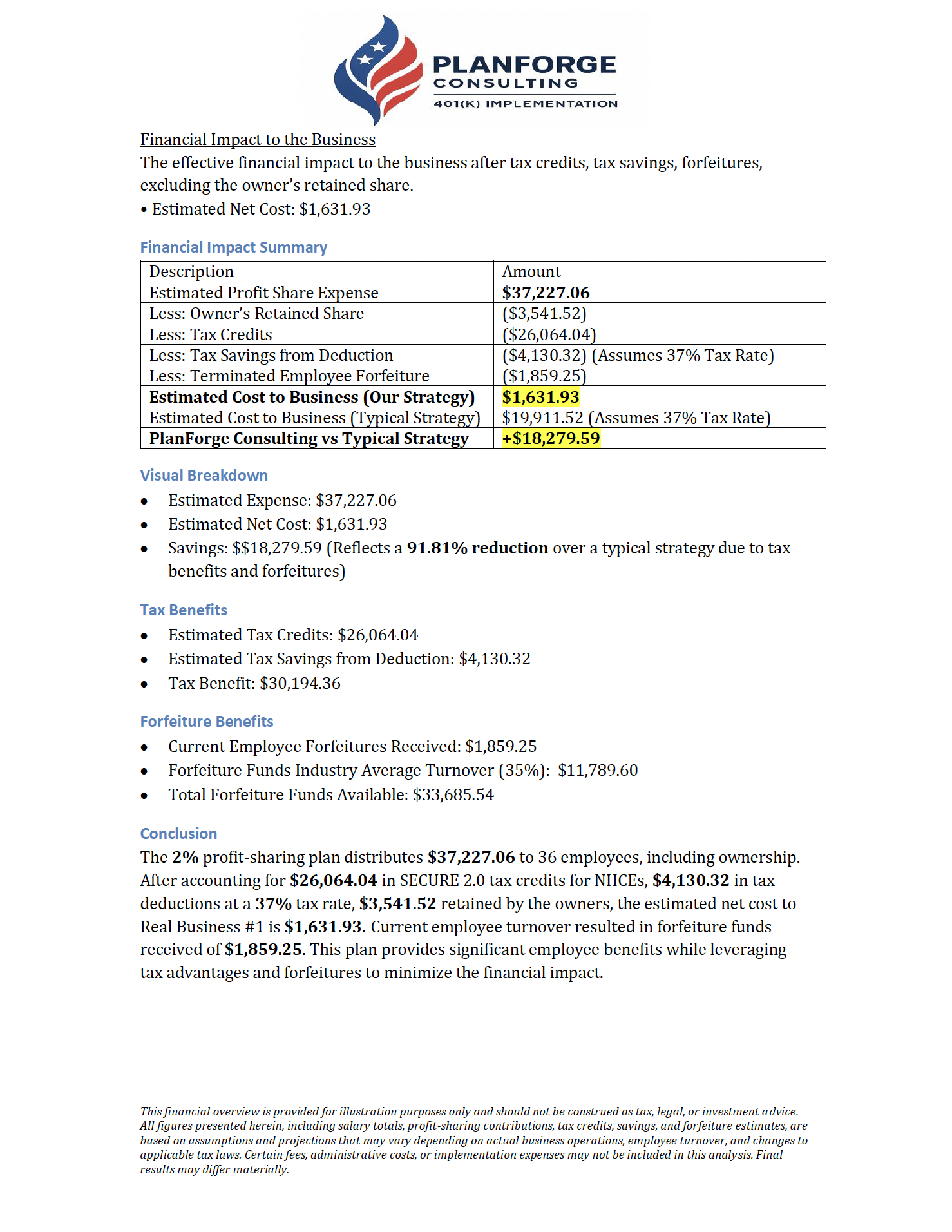

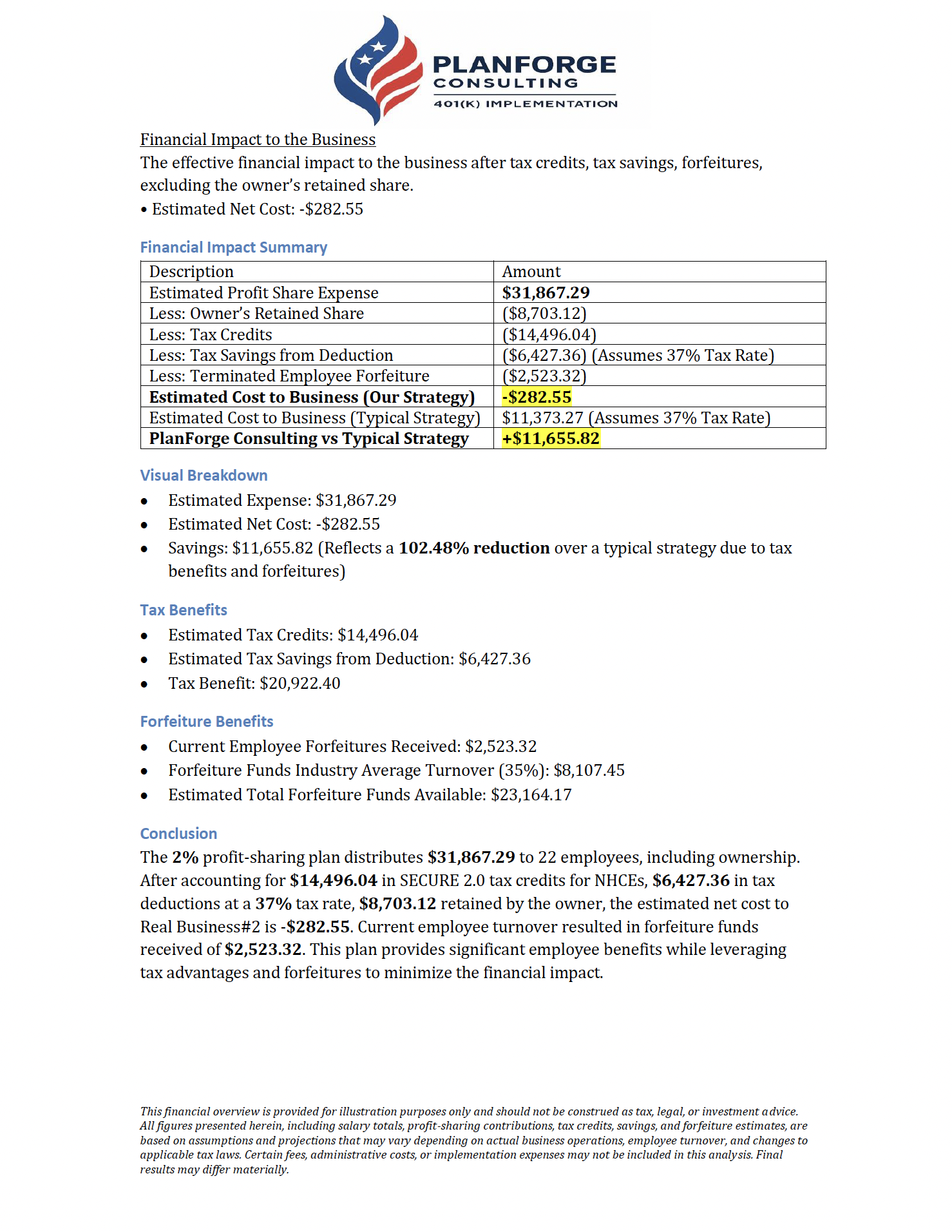

Our customized 401(k) plans help small businesses reduce costs, maximize tax credits, and attract top talent. With SECURE Act 2.0 strategies, most of our clients cut costs by 90% or more — often reaching net‑zero cost. We align every plan with your goals to deliver real savings and a competitive advantage.

How Free 401(k) Illustrations Work

3-Minute Ownership & Payroll Questionnaire

Fill out our brief Questionnaire to share your business structure & employee demographics. No documents required.

Prefer best accuracy? Secure Upload (W-2s & Census)—you can also upload later.

We Optimize Credits, Deductions & Plan Design

Our experts model SECURE Act 2.0 credits, tax deductions, employer match/profit-sharing, and likely forfeitures to optimize your plan—then show PlanForge's Strategy compared to the average 401(k) in a simple side-by-side.

Receive PDF

You’ll receive a Customized PDF illustration of your potential savings and net cost, plus the option to schedule a 20-minute Zoom review to walk through the results.

20-min Zoom Review

Schedule a 20-minute Zoom review to walk through your Customized PDF, confirm assumptions, and choose the lowest-cost path. We’ll answer questions, coordinate with your CPA/payroll, and outline clear next steps—no pressure.

Success Stories

Get in Touch

Contact Planforge Consulting

We’re here to help small business owners implement cost-effective 401(k) plans. Schedule a free consultation or submit last year’s W-2s for a custom quote today.

Schedule a Free Consultation

Discover how much you could save on your retirement plan. Schedule your free consultation now or call us at 214-908-2310.

Submit W-2s or Questionnaire

Upload your last year's W‑2s or fill out our Owner questionnaire to receive a personalized illustration of your potential savings.

Reach Out Directly

Have questions or interested in partnership opportunities? Contact us by email at Partnerships@PlanForge401k.com or complete our 3-minute Partnership Form. We're happy to assist you.